How it Works: Prop Firms Explained

How it Works: Prop Firms Explained

Prop firm trading (short for proprietary firm trading) refers to a trading model where a company, known as a proprietary trading firm or “prop firm,” provides traders with capital to trade financial instruments such as stocks, forex, futures, options, or cryptocurrencies. The primary objective is for traders to generate profits using the firm’s money, which is typically shared between the trader and the firm according to an agreed profit split.

Why People Use Prop Firms?

1. The Importance of a Simulator (Demo Account)

All traders start their journey on a simulator (demo account)—a critical first step that protects their capital while they build essential trading skills. Successful traders demonstrate consistent profitability in a simulator before transitioning to live trading.

However, this shift from simulated to live trading can be challenging due to emotional pressures, which often lead to poor decision-making and capital losses.

2. How Proprietary Trading Firms (Prop Firms) Help

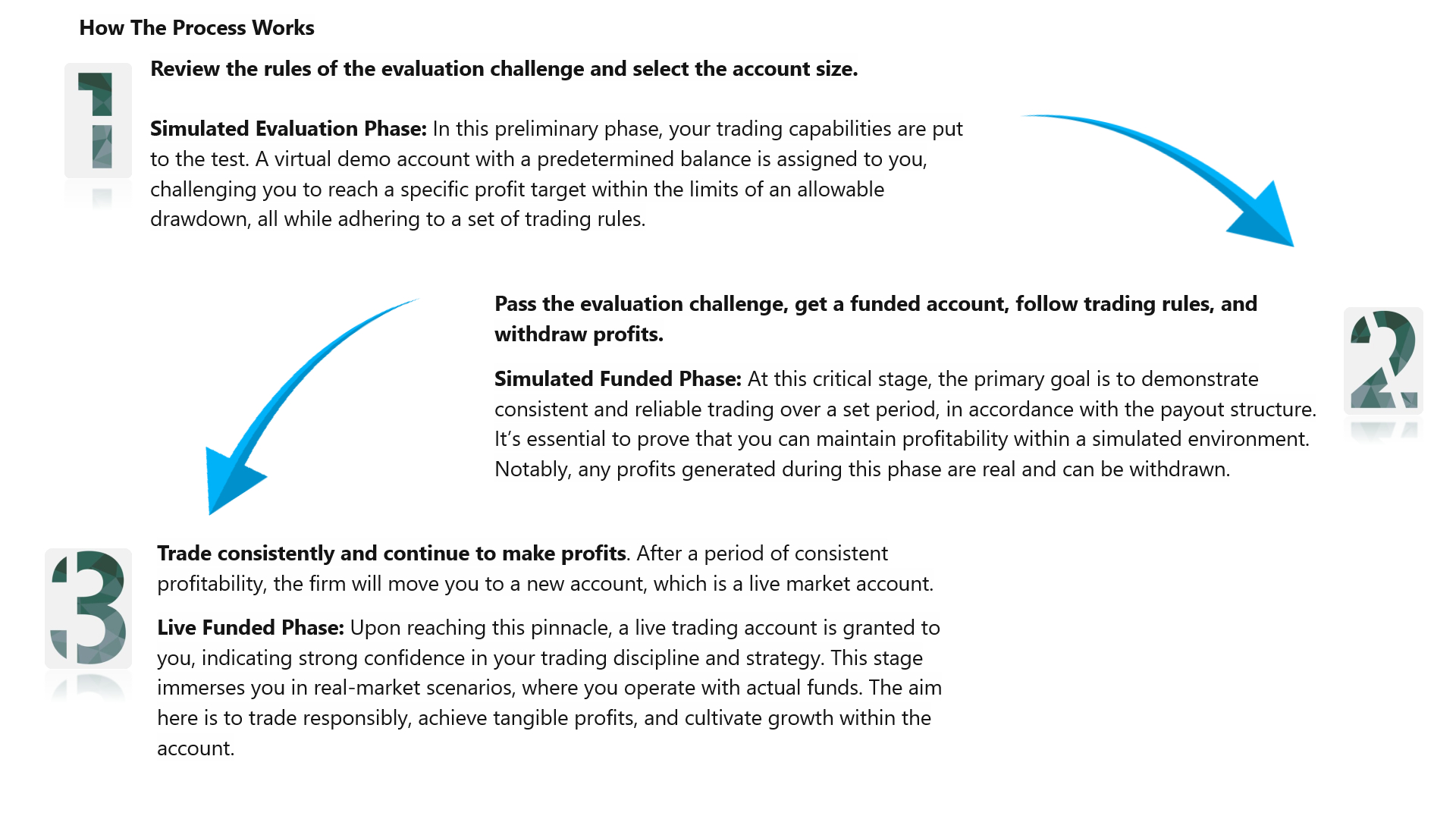

Proprietary trading firms serve as a bridge between simulation and live trading. These firms offer traders access to capital in exchange for a small evaluation fee. To qualify, traders must:

- Pass the firm’s evaluation process

- Adhere to strict trading rules

This model is especially beneficial for beginner traders, as it:

✅ Provides capital access without personal risk

✅ Encourages discipline and emotional control

✅ Prevents traders from losing their own money—they only risk the evaluation fee

3. The Right Mindset for Prop Firm Trading

Prop firms are not a shortcut to success. Instead, they are tools to help traders transition safely from simulation to live trading.

Key Advice: If you are not yet profitable on a simulator, focus on refining your skills before applying for a prop firm account. A strong foundation is crucial for long-term success.

4. Additional Benefits of Prop Firms

✅ Access to Professional Trading Tools – Many prop firms provide free access to premium trading platforms and real-time market data, reducing startup costs for new traders.

✅ Scaling Trading Strategies Efficiently – Instead of using personal funds to increase position sizes, traders can:

- Purchase smaller prop firm accounts

- Use trade copiers to replicate trades across multiple accounts

This strategy reduces emotional stress while enabling traders to scale their strategies effectively and make more money.

Prop Firms Comparison: The Best Prop Firms no particular order

We have identified the most important criteria to evaluate and compare each prop firm. For this analysis, we selected a $50,000 account as the standard and factored in current discounts for evaluation costs. Please note that prices may vary over time depending on company promotions and discounts.

Additionally, some prop firms impose rules on trading during high-impact news events or around market close. While these rules differ from firm to firm, we generally recommend avoiding trading during high-impact news releases and stopping trading 15–30 minutes before the market closes to minimize risk and maintain discipline.

| Company | 50K Evaluation Cost | Activation Fee | Reset Fee | 50K Evaluation Rules | Trading Days Required For Evaluation | Numbers Of Accounts Allowed | Platforms | Profit Split | Rules I Funded Account | Rules II (Additional comments) | Payout Requirements | Withdrawals | Days Until Approval | Esablished | Strong & Weak Sides | Action |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Earn2TradeGET YOUR EVALUATION Earn2TradeGET YOUR EVALUATIONCODE: TWAClick to copy | $95.00 | $0 - NO Activation fee upfront. Fee $139 is taken only after first payout. | $100 | 1. Hit The Profit Target $3000 | 10 Days required | 3 Accounts | NinjaTrader® Finamark | 80% | Progression Ladder (Reasonable scaling rule some companies are more strict, this is actually very solid scaling plan) | Trade permitted hours( industry standard, no overnight trading). They allow news trading, No trade copier | Weekly Once Funded, No rules to get payouts just the minimum $100 and have enough for the first fee | Minimum $100. $10 Fee - Withdrawal $500 and above will incur no fee. Bank Wire, Crypto withdrawal. Rise | Once a week payouts, Processed in few days. | 2016 United States | Strong Sides Overall, Earn2Trade seems like a solid, reliable choice for serious traders but might not be ideal for those looking for fast or ultra-flexible funding options. | Learn More |

TradeDayGET YOUR EVALUATION TradeDayGET YOUR EVALUATIONCODE: TWAClick to copy | $75 | $139.00 | $99.00 | 1. Hit The Profit Target $3000 | 7 Days Required | Only 1, no copy trader. | Tradovate | 90% | The rules for the funded trader are the same rules as the evaluation. Which is good, they are not trying to change things up on you in the middle of the process. Minor Rules: | No holding positions when market closes. Close position 10 min before market close. Trader permitted products(industry standard) | Create a buffer like most prop firm have - $2000. No other payout rules! | Min $250, Rise, crypto | On demand, no restriction on withdrawals | 2020 United States | Strong Sides | Learn More |

TOPSTEPGET YOUR EVALUATION TOPSTEPGET YOUR EVALUATION | $49.00 | 149 One-Time | $49.00 | 1. Do not allow your Account Balance to hit or go below the Maximum Loss Limit. | 2 Days Required | 5 Accounts | TradingView Tradovate Sierra Chart T4 ATAS (Order Flow Trading) Jigsaw Trader R|Trader Volfix MultiCharts MotiveWave Bookmap X-RAY Trade Navigator Investor/RT | 90% | Progression Ladder (Scaling plan rule) its not the worst scaling plan but it can slow you down due to limited number of contracts that can be traded. $0-1500$ - 2 Contracts | For each payout traders must have 5 winning days to withdraw 50% and 30 winning days to withdraw 100%. Winning day means $200 profit per each day | Minimum $125 | Few Days | 2012 United States | Strong Sides: | Learn More | |

TradeifyGET YOUR EVALUATION TradeifyGET YOUR EVALUATIONCODE: twaClick to copy | Advanced - $49 The Advanced Challenge uses a real-time Intraday Trailing Max Drawdown, which is calculated continuously throughout the trading day. The benefit of this is that for disciplined traders the intraday trailing drawdown can protect you from significant losses during the day and encourages you to lock in profits. | The only account with an activation fee is the Advanced Sim Funded Account. One time fee of $125.There is no activation fee for Growth Challenges, and Straight to Sim Funded products are one time fees.

| Advanced - $45 | Profit Goal $3000 | 1 Day Required! | 5 Accounts | Tradovate, Ninjatrader, Tradingview | 90% | Daily Loss Limit NONE | News Trading. They do not have any rules against or guidelines around trading news events, Dollar Cost Averaging (DCA), flipping, or scaling. Soft Breach means your account is locked for the day to prevent traders from blowing the account. | Consistency Rule 35% | Min $500 and max increase with each payout, RISE, $10 withdrawal fee | Within 1 Day | 2022 United States | Learn More | |

TradeifyGET YOUR EVALUATION TradeifyGET YOUR EVALUATIONCODE: twaClick to copy | Growth - $90 The Growth Challenge uses an End of Day Trailing Max Drawdown, which is calculated and based on the account balance at the end of the trading day. The Growth Challenge accounts offers more flexibility during the trading day. Intraday fluctuations won’t affect the drawdown level, allowing you to hold positions with less risk of hitting the drawdown limit due to temporary losses. | NO Activation Fee | $85 | Profit Goal $3000 | 1 Day Required! | 5 Accounts | Tradovate, Ninjatrader, Tradingview | 90% | Daily Loss Limit (Soft Breach) $1 250 | Trader permitted products(industry standard) | Consistency Rule 35% | Min $500 and max increase with each payout, RISE, $10 withdrawal fee | Within 1 Day | 2022 United States | Strong Sides: | Learn More |

TradeifyGET YOUR EVALUATION TradeifyGET YOUR EVALUATIONCODE: twaClick to copy | Straight To Sim Funded - $384.30 ONE TIME FEE For Life If you’re a new trader and have never received a payout, don’t jump straight into a funded account. First, get comfortable trading a prop firm account and gain more experience. This option is more expensive and is best suited for experienced trader | NO Activation Fee | Straight To Sim Funded Account | Straight To Sim Funded Account | Straight To Sim Funded Account | 5 Accounts | Tradovate, Ninjatrader, Tradingview | 90% | Daily Loss Limit (Soft Breach) $1 250 | Idle Time Rule - 1 trade per week (Many prop firms have this these days but you can text them and let them know you are on a vacation and they can work with you) | Consistency Rule 20% | Min $1000 and max increase $2000-$2500, RISE, $10 withdrawal fee | Within 1 Day | 2022 United States | Learn More | |

BluSkyGET YOUR EVALUATION BluSkyGET YOUR EVALUATION | $95.00 | NO Activation Fee | $65.00 | Profit Goal $3000 | No specific number of days | 3, Copier Allowed | NinjaTrader Tradovate Bluplus + | 90% | BLUE LIVE | Scaling plan Live Funded Account (Only for those that had 3 or more attempts at brokerade funded account) - You start with 1 mini and then for every $1500 profit you can add 1 contract | You can withdraw above initial starting Balance - $3000 | Min $250, Maximum Initial Payout $400, no limit after that, unlimited but can request any day and fast payout ACH | Same Day Payout Processing, Fast! | 2022 United States | Strong Sides | Learn More |

Apex Trader FundingGET YOUR EVALUATION Apex Trader FundingGET YOUR EVALUATIONCODE: TWAClick to copy | $33.40 | $125 Lifetime | $80.00 | Rule 1: Hit Your Profit Target Rule $3000 | 7 Days required | 20! Copier Allowed | NinjaTrader 8, Tradovate can ONLY be used on Tradovate Web or Mobile, TradingView, or NinjaTrader (Desktop Version or Mobile app). | 90% | Scaling Rule (Good) - 5 Contracts, Full 10 after clearing the Buffer $2600 Consistency Rule 30% 30% Negative P&L Rule - Open trades should not exceed a 30% negative drawdown from the account’s profit balance. Maintain a maximum 5:1 Risk-Reward Ratio on Trades Intraday trialing dradown (until treshold) | DCA allowed, Contract Size Consistency (Don't trade 10 contracts one day and 2 the next day, keep it consistent), News trading is allowed, Flipping trades is allowed | Complete 8 trading days, with at least 5 of those days having a profit of $50(Low) or more. Create a Buffer Safety Net $2600(First three payouts) | $500 minmimum, max $2000 only for first five payouts, ACH, Wise | Request payout anytime. 48 hr approval | 2021 United States | Strong Sides | Learn More |

Take Profit TraderGET YOUR EVALUATION Take Profit TraderGET YOUR EVALUATIONCODE: THWAClick to copy | $85.00 | $130.00 but lot of promos include NO Activation Fee | $100.00 | 1: Hit Your Profit Target Rule - Goal $3000 | 5 (trading day at least 1 trade executed) | 5 | Tradingview, NinjaTrader, Tradovate, Bookmap, MultiCharts, MotiveWave, Trade Navigator, R|Trader, VolFix, ATAS, Investor R/T, Quantower, Finamark, Jigsaw Trader | Pro + (Live Funded) 90% Pro (Finded Sim) 80% | Trailing Intraday drawdown and not EOD anymore for the buffer zone. Its static after balance reached. No consistency rule on funded accounts. Don't exceed maximum contract size 6 | After passing evaluation you get PRO funded account sim and then PRO + which is live. Each trader that will reach a $5 000 profit in the PRO account will be presented with opportunity to move on to PRO+ account. Live pro + account $135 per data/month as every prop firm. You can reset funded accounts so you don't have to go through evaluation again but its fairly expensive. Trader permitted products (industry standard), trade permitted hours (industry standard). Trade at least 1 trade per week. | Create a buffer like most prop firm have - $2000. No other payout rules. | Plaid, Paypal or Wise, no maximum amount. No fee for withdrawal $250 and above. | 0 - Very fast payouts, sometimes same day | 2021 United States | Strong Sides | Learn More |

My Funded Futures CoreGET YOUR EVALUATION My Funded Futures CoreGET YOUR EVALUATIONCODE: twadeClick to copy | $73.00 | None | $77.00 | 1. Hit The Profit Target $3000 | 2 Days Required | 3 Accounts 3 Minis 30 Micros | NinjaTrader | 80/20 | Consistency Rule None | Microscalping Yes(after update not a problem, only 1 point on ES and smaller is problem) Live account is given after 5 consecutive payouts or profitable 30 days Starting balance $2500.00 | Max payout request $1000.00 per pay out | Minimum payout $250.00 | Very fast payout | 2022 United States | Strong Sides | Learn More |

My Funded Futures ScaleGET YOUR EVALUATION My Funded Futures ScaleGET YOUR EVALUATIONCODE: twadeClick to copy | $121.00 | None | $127.00 | 1. Hit The Profit Target $3000 | 2 Days Required | 3 Accounts 3 Minis 30 Micros | NinjaTrader | 80/20 | Consistency Rule None | Microscalping Yes(after update not a problem, only 1 point on ES and smaller is problem) Activity Account Rule - 1 Trade per week Live account is given after 5 consecutive payouts or profitable 30 days Starting balance $3000.00 | Max payout request $1500.00 to $3500.00 per pay out 1st payout is $1500.00 then it scales up to $3500.00 Minimum of 5 profitable days of at least $100.00 | Minimum payout $250.00 | Very fast payout | 2022 United States | Strong Sides | Learn More |

My Funded Futures ProGET YOUR EVALUATION My Funded Futures ProGET YOUR EVALUATIONCODE: twadeClick to copy | $215.00 | None | $227.00 | 1. Hit The Profit Target $3000 | 2 Days Required | 3 Accounts 3 Minis 30 Micros | NinjaTrader | 80/20 | Consistency Rule None

| Microscalping Yes(after update not a problem, only 1 point on ES and smaller is problem) Activity Account Rule - 1 Trade per week Live account is given after 3 consecutive payouts or every $20,000, MFFU reviews your account Starting balance $2000.00 to $5000.00 | Just create buffer and then withdraw anything above Maximum earnings per user $100 000.00 before live account | Minimum payout $3000.00 | Very fast payout | 2022 United States | Strong Sides | Learn More |

Comments:

1) TakeProfitTrader has recently gained significant attention and quickly established itself as one of the top proprietary trading firms. The firm offers affordable funding costs and straightforward rules, along with a highly favorable payout policy. Notably, there are no additional rules, such as scaling or contract rules—traders are simply required to generate a reasonable buffer, and beyond that, there are no further restrictions, which is a strong advantage.

1) TakeProfitTrader has recently gained significant attention and quickly established itself as one of the top proprietary trading firms. The firm offers affordable funding costs and straightforward rules, along with a highly favorable payout policy. Notably, there are no additional rules, such as scaling or contract rules—traders are simply required to generate a reasonable buffer, and beyond that, there are no further restrictions, which is a strong advantage.

Payouts with TakeProfitTrader are notably fast, which adds to its appeal. However, one potential concern is how sustainable this will be as more customers join the platform. So far, the firm has managed growth effectively.

The company is also known for running large promotions, offering more than just discounts—there are often promotions with no activation fees, no daily limits, and other benefits. This makes it important for traders to keep an eye on the excellent deals, as TakeProfitTrader frequently offers these promotions, unlike many of its competitors. Additionally, the firm features a rewarding system that enables traders to earn free accounts and resets in the future—an offering that is rare among other proprietary trading firms.

However, there are some drawbacks to consider. During the evaluation phase, there is no trailing drawdown. But once you progress to the PRO (funded sim) or PRO+ (live funded) levels, trailing drawdown is introduced, making it more challenging to allow profitable trades to run. Additionally, the profit split is only 80% for the PRO account, whereas the PRO+ account offers the standard 90% split. While this restriction in the PRO account may seem somewhat unnecessary, the overall benefits of TakeProfitTrader far outweigh these limitations. Without promotions, TakeProfitTrader is rather expensive compared to other competitors so its very important to wait for trader friendly discounts.

![]() 2) MyFundedFutures has established itself as one of the leading prop firms in the industry. The firm offers one of the most affordable paths to funding, while maintaining straightforward and easy-to-pass evaluation rules. Payouts are processed quickly, and there are no hidden rules or gimmicks to worry about.

2) MyFundedFutures has established itself as one of the leading prop firms in the industry. The firm offers one of the most affordable paths to funding, while maintaining straightforward and easy-to-pass evaluation rules. Payouts are processed quickly, and there are no hidden rules or gimmicks to worry about.

On the downside, traders are transitioned to live accounts relatively quickly, and MyFundedFutures does not frequently run promotions or discounts. Additionally, while the Core account is the lowest-cost option, it comes with a cap on simulated profits. This limitation often pushes traders toward the Scale account, which—while still competitive—removes MyFundedFutures from holding the absolute cheapest path to funding compared to certain other prop firms.

Core, Scale, and Pro Plans — What’s the Difference?

When you compare accounts of the same size (50k vs 50k, 100k vs 100k, etc.), the evaluation process is identical across all three plans.

The main distinctions come into play once you reach the funded stage — payout structure, scaling options, live account setup — which is what explains the price differences between plans.

Evaluation Rules for All Plans

Regardless of whether you choose Core, Scale, or Pro, every evaluation follows the same rules:

-

✅ Pass as quickly as 2 days (with a 50% consistency requirement)

-

✅ No daily loss limits and no restrictions on trading news events

-

✅ Same maximum position size when comparing equal account sizes (e.g., 50k Core vs 50k Pro)

-

✅ Pro accounts only: once funded, your maximum position size increases!

MyFundedFutures Offers Three Main Plans. Which Plan Should You Choose?

Core(Only has 50k):

-

Want the lowest-cost path to funding

-

Prefer no buffer rule before payouts

- You don’t mind a $5,000 cap on sim profits

Scale:

-

Want access to 100k or 150k accounts without needing Pro’s premium features

-

Value no buffer rule before payouts

- Prefer a larger profit cap and higher payout per request compared to Core

Pro(For more advanced traders):

-

Want the highest earning potential and benefits before transitioning to a live account

-

Prefer bigger starting position sizes:

-

50k account → 5 minis / 50 micros

-

100k account → 10 minis / 100 micros

-

150k account → 15 minis / 150 micros

-

-

Are an experienced trader who can maximize the plan’s advantages (justifying the higher price)

![]() 3) Tradeify is a relatively new proprietary trading firm, but it has already built a strong reputation. The company frequently offers promotions and discounts, making its evaluation process more affordable. The evaluation rules are well-structured, providing a beneficial and fair challenge for traders.

3) Tradeify is a relatively new proprietary trading firm, but it has already built a strong reputation. The company frequently offers promotions and discounts, making its evaluation process more affordable. The evaluation rules are well-structured, providing a beneficial and fair challenge for traders.

One of Tradeify’s standout features is its three main product offerings, catering to traders at different stages of their journey. Notably, the firm also provides a straight-to-funded option, which is an exciting opportunity for experienced traders looking to bypass the evaluation process.

Tradeify offers reasonable payout rules. In the past tradeify had strict rules but the company listened to traders, improved and now tradeify’s rules match other competitors. Payouts are processed quickly, the user interface is intuitive, and their customer support is reliable—all positive aspects of the firm.

The straight-to-funded option is particularly attractive, especially for traders who have previously received payouts and have experience in live markets. However, this account also comes with strict rules, which might be frustrating for those looking for greater freedom after getting funded. Tradeify’s goal is to move traders to live trading as quickly as possible, which is understandable, but greater flexibility in the funded phase would be an improvement.

Tradeify shows strong potential and is worth considering for diversification. The company regularly updates its rules in response to competitive pressures, often making improvements in favor of traders—a positive sign for the future. Tradeify increased their promotions lately and their evaluations are cheap and very trader friendly. Only 1 day to pass. The customer support has been extremely helpful.

One of its biggest advantages is the frequent promotions, which provide great opportunities for discounted access. If you’re patient and wait for a good promo, Tradeify is a fantastic choice.

4)Earn2Trade is one of the oldest and most established proprietary trading firms in the industry. Over the years, it has maintained a strong reputation with no history of negative events or scandals. The company has received positive reviews and has a consistent track record of reliable payouts. With a solid leadership team and a long-standing presence in the market, Earn2Trade is known for its credibility and stability.

4)Earn2Trade is one of the oldest and most established proprietary trading firms in the industry. Over the years, it has maintained a strong reputation with no history of negative events or scandals. The company has received positive reviews and has a consistent track record of reliable payouts. With a solid leadership team and a long-standing presence in the market, Earn2Trade is known for its credibility and stability.

The firm frequently offers promotions and discounts, making its pricing competitive—especially since there is no initial activation fee. Instead, traders pay the activation fee only after receiving their first payout, which is a significant advantage.

Earn2Trade offers two main products: The Gauntlet Mini, which functions as a standard proprietary trading evaluation, and the Trader Career Path, a progressive funding model that allows traders to upgrade to larger accounts after each successful payout. This is a unique and appealing feature for those looking to scale their accounts gradually without significant upfront costs.

Upon passing the evaluation, traders can choose between a LIVE SIM or LIVE Funded account. However, the evaluation process is not the easiest to pass; unlike some firms where traders can qualify in a day or two, Earn2Trade focuses on attracting serious traders rather than those seeking quick funding. This may be seen as a downside for some, but it reinforces the company’s commitment to quality traders.

While the evaluation rules could be slightly more favorable to traders, the firm’s goal is to filter out short-term, high-risk traders who attempt to pass evaluations hastily. Unlike some newer proprietary firms that offer flashy incentives, such as instant funding or extensive reward systems, Earn2Trade prioritizes long-term stability and transparency. In return, traders benefit from a reliable payout policy, great customer support, reliable and structured trading environment without hidden fees, misleading conditions, or unexpected restrictions.

5)UPDATE 8/2025 – TradeDay has increased its Profit Target on their accounts and no longer offer small 25k accounts with great Risk to Reward Ratio. The competitive advantage of favorable R:R ratios is no longer offered and there are other, better prop firms.

TradeDay is a well-established proprietary trading firm with highly positive reviews. The company was founded by real traders with the goal of funding serious traders, which is evident from its straightforward rules and conditions. There are no gimmicks or hidden rules, making it a transparent and trustworthy choice for traders.

While TradeDay is not the cheapest option available, it offers some of the most straightforward and simple rules in the industry. The firm has one of the lowest profit targets for evaluations, and its payout policy has no restrictions. This makes it one of the most realistic funded trading experiences.

The firm has a strong payout policy and provides a 14-day free trial, which is a valuable opportunity for traders to familiarize themselves with the process. However, a notable limitation is that TradeDay only allows one account per household, as they want traders to focus on a single account. This can be a disadvantage for those looking to scale multiple accounts but makes TradeDay a great option for traders who prefer to concentrate on one account while diversifying across other proprietary firms.

TradeDay also offers small accounts with one of the best Profit Target to Drawdown ratios in the industry, making it an attractive choice. The firm places a strong emphasis on real trading, meaning traders must actively participate rather than place occasional trades just to maintain activity. As long as traders meet their targets and remain engaged, they can expect a smooth experience.

The rules for evaluation and funded accounts are consistent, which is a positive aspect. Additionally, the minimum buffer required before withdrawal is relatively small, making it easier to access profits. While TradeDay does not frequently offer promotions, its pricing model provides value by offering lower profit targets and better drawdown buffers in return. Although it may be slightly more expensive upfront compared to competitors, traders benefit from a structured, transparent, and trader-friendly environment.

6)UPDATE 7/2025 – Topstep stopped support for Ninjatrader and launch its own trading platform. This platform is not ideal for trading and Topstep is no longer recommended prop firm.

6)UPDATE 7/2025 – Topstep stopped support for Ninjatrader and launch its own trading platform. This platform is not ideal for trading and Topstep is no longer recommended prop firm.

Topstep is a well-established proprietary trading firm with a long history and no major negative scandals. The company is known for its stability and consistent payout history, making it a reliable choice for traders. It offers reasonable pricing and clear rules, providing a structured evaluation process.

One of Topstep’s key advantages is its short two-day evaluation period, allowing traders to qualify for a funded account relatively quickly. However, the payout rules can be somewhat restrictive, making withdrawals more challenging compared to some other firms. Additionally, the scaling plan for funded accounts is not the most competitive, which may be a drawback for traders looking to grow their accounts rapidly. That said, for those who are patient and willing to build their accounts gradually, this may not be a major issue.

Unlike some competitors, Topstep has not offered many discount promotions recently, though this is something to keep an eye on. Despite this, it remains a solid and reputable option for traders seeking a structured and stable trading environment.

7) BluSky is a solid proprietary trading firm and one of the cheapest options upfront in terms of the true cost of getting funded. Unlike many competitors, BluSky even covers brokerage account fees, making it an attractive choice for cost-conscious traders.

7) BluSky is a solid proprietary trading firm and one of the cheapest options upfront in terms of the true cost of getting funded. Unlike many competitors, BluSky even covers brokerage account fees, making it an attractive choice for cost-conscious traders.

BluSky’s evaluation rules are straightforward and similar to those of other prop firms. A notable feature is its updated consistency rule, which has been slightly adjusted to make trading easier for participants.

After passing the evaluation, traders must first reach another profit target before moving to the BLUE LIVE account. While this might seem like a second evaluation at first glance, it functions more like a “buffer-building stage.” The good news is that all profits earned during this phase are transferred to the live brokerage account once the target is met.

Once you transition to the live account, you can withdraw funds immediately, which is a big advantage. BluSky’s approach prioritizes moving traders to live trading as quickly as possible, a huge plus for those who prefer trading in a real environment rather than a simulated funded account.

- No payout restrictions, but traders must first build a buffer—a standard practice in the industry.

- Minimum account balance requirement—some prop firms have lower or no such requirement.

- The transition from evaluation to live trading can increase psychological pressure, as it skips an intermediate simulated funded phase.

BluSky is one of the most affordable firms in terms of initial evaluation costs. With no activation fee upon reaching the funded stage, its true cost to funding is among the lowest in the industry.

It sits in a similar category as Apex but without the ability to trade up to 20 accounts simultaneously. Compared to TradeDay, BluSky is cheaper upfront but requires a higher profit target and buffer after funding. TradeDay, on the other hand, is slightly more expensive initially but has smaller target profits and buffers. Ultimately, the choice between these firms comes down to personal preference and trading style.

BluSky also has a strong reputation, with excellent reviews and a history of fast payouts. There are no known instances of fraudulent behavior, making it a trustworthy and cost-effective option for traders looking to get funded.

8)Apex Trader Funding is one of the largest proprietary trading firms in the industry. With the highest total payouts among all prop firms, Apex has established itself as a major player.

8)Apex Trader Funding is one of the largest proprietary trading firms in the industry. With the highest total payouts among all prop firms, Apex has established itself as a major player.

✅ Frequent Promotions – Runs aggressive discounts (up to 90%) and 1-day pass evaluations.

✅ High Account Limit – Trade up to 20 accounts, one of the highest in the industry.

✅ Simple Evaluation Rules – Easy-to-follow rules, making passing very achievable. The best drawdown limit for evaluations of all prop firms.

✅ Affordable Entry Costs – Due to regular promotions, Apex offers some of the cheapest evaluations.

Apex excels in low-cost evaluations with easy rules, making it one of the most accessible firms for traders. However, once traders move to a funded account, there is a noticeable increase in restrictions and rules. Since the Apex is the biggest prop firm in the industry and it offers the cheapest accounts in the industry, it attracts all types of traders. Traders with very aggressive strategies, traders with “yolo” mindset etc. I understand that Apex is trying to filter “yolo ” traders but funded accounts have more rules then its necessary.

Stricter Rules for Funded Accounts – Designed to filter out aggressive and inconsistent traders.

Emphasis on Consistency – Funded traders must follow a disciplined, structured approach.

Live Intraday Trailing Drawdown – Applies to both evaluation and funded accounts (until threshold), making it harder to hold runners.

These rules favor structured, systematic traders over those with aggressive or inconsistent strategies. PATS-style traders will have no issues, as their approach is based on scalping with runners and maintaining consistency while following rules of the strategy.

Apex is a dominant prop firm with some of the easiest and cheapest evaluations. Funded account rules lack behind some of the competitors, and the intraday live trailing drawdown can be a challenge for holding bigger targets. While PATS traders will be fine. With good discount promotions, apex can provide the cheapest accounts and the easiest evaluations in the business. If you wait for solid promo, apex is a great choice.

How to Choose a Trading Prop Firm

Choosing the right proprietary trading firm (prop firm) can be a daunting task, especially with so many options available and various factors to consider. In this article, we will explore the key criteria to help you identify the best prop firm for your needs.

- Company Reputation and Reviews

It is crucial to select a prop firm with a strong reputation and positive reviews. Avoid companies with scandals, complaints, or a history of poor customer service. Look for firms with transparent leadership and a demonstrated commitment to customer satisfaction. Online forums, trader communities, and independent review platforms can provide valuable insights into a company’s reputation.

- True Cost of Funding

The cost of getting funded is one of the most important factors to evaluate. This includes not only the initial evaluation fees but also potential activation fees and any hidden charges. Keep in mind that prop firms operate as businesses and aim to generate profits.

- Some firms offer low-cost evaluations with strict rules, while others may have higher fees but more lenient requirements.

- Consider your trading style and preferences when assessing these costs.

- Take advantage of promotions and discounts offered by prop firms to minimize expenses.

- Evaluation and Funded Account Rules

Prop firms implement rules to ensure they fund responsible and consistent traders rather than reckless risk-takers. Many traders just sign for evaluatins to „yolo“ and gamble. These rules are designed to verify a trader’s skill and reliability, as firms often seek to replicate profitable trades. So we understand why these rules exist.

- Look for firms that strike a balance between reasonable rules and flexibility.

- Compare firms to find one with rules that align with your trading style and make the process as straightforward as possible.

- Withdrawal and Payout Policies

The withdrawal process is one of the most critical factors when choosing a prop firm. Some companies impose strict rules and delays to make withdrawals challenging.

- Carefully review the firm’s FAQ and terms to ensure payouts are processed quickly and without unnecessary restrictions.

- Choose a firm with fast, reliable, and straightforward payout policies to avoid frustrations down the line.

- Customer Support and FAQ

Your money is on the line, so it is essential to select a company with responsive and reliable customer support.

- A trustworthy prop firm should be willing to assist with any issues or questions promptly.

- While larger firms may take longer to respond due to higher volumes, the quality of support and willingness to help should remain high.

- Trading Tools and Platforms

Evaluate whether the prop firm offers trading tools and platforms that align with your needs. Check if they support:

- Platforms you are comfortable using.

- Algorithmic trading, bots, and trade copiers.

- Any other tools essential to your trading strategy.

Important Considerations for Using Prop Firms

It’s crucial to understand that prop firms are businesses designed to generate profit, and that’s perfectly fine. However, as traders, we must be aware of this reality and leverage their services to benefit ourselves. The key is to remain detached from any single prop firm. Continuously monitor the prop firm landscape and be prepared to adapt if better opportunities arise with other firms.

Prop Firms Are Tools, Not Partners

Prop firms should be viewed as tools to generate income with minimal risk. To maximize their potential:

✅Only engage with prop firms when you are ready and consistent on a simulator (SIM). Prop firms are not short cut, you must learn on SIM and transition to prop firms when you can be at least somewhat consistent on the SIM. Always protect your hard earned capital!

✅Set aside a small, designated budget each month for prop firm evaluations. Treat this budget as part of your business expenses.

⚠️Be cautious of small evaluation fees adding up over time. Sometimes its easy to get carried away with big discounts. Stay disciplined and treat these accounts as seriously as you would a live account because, eventually, they will transition to live accounts.

Budgeting and Planning

- Think of your prop firm expenses as an investment in yourself, your future, and your trading education. Just as others might spend money on hobbies or vices like smoking or drinking, allocate a portion of your budget toward your trading journey. This mindset ensures you treat trading with the seriousness it deserves while maintaining financial discipline.

️Diversify Across Multiple Prop Firms

- To mitigate risks, it’s a good idea to diversify your accounts across multiple prop firms. This protects you from potential scandals or unexpected changes in policies. By spreading your accounts, you reduce dependency on any single firm and safeguard your trading operations.

Do Your Own Research

- Always conduct thorough research before committing to a prop firm. Review their policies, fees, and reputation to ensure they align with your goals. Staying informed and adaptable is essential in the ever-changing prop firm environment.

Dradowns Guide Explanation

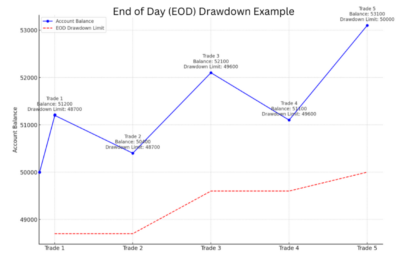

End-of-Day (EOD) Drawdown

The End-of-Day (EOD) drawdown is assessed at the close of the trading day. If the account balance achieves a new high at the end of the session, the drawdown limit is adjusted upward. However, intraday activity does not affect the drawdown unless the limit is breached, which results in account termination. This system provides traders with flexibility during the trading day, as the drawdown is only recalculated based on the account balance at market close.

Key Characteristics of EOD Drawdown

- The EOD drawdown is calculated exclusively after the market has closed.

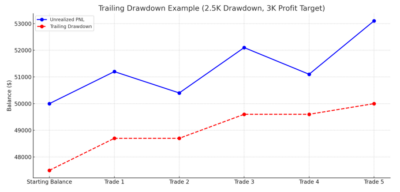

Unrealized Trailing Drawdown

An unrealized trailing drawdown adjusts continuously, based on the account’s highest reached balance, including unrealized profits and losses from open positions. If an open position achieves a significant profit, the drawdown limit trails this peak, reducing the remaining drawdown cushion. This type of drawdown is more demanding, as traders must carefully manage open positions and their impact on the drawdown threshold.

Key Characteristics of Unrealized Trailing Drawdown

- The drawdown follows the account’s highest unrealized balance, including both open and closed trades.

Static Drawdown

Static drawdown is the most straightforward and predictable method. In this system, the drawdown limit remains fixed and does not change, regardless of fluctuations in the account balance. It provides traders with a clear and unchanging risk threshold.

The maximum drawdown ceases to increase once it reaches the account’s starting balance. For example, if a funded account begins with $50,000 and the maximum drawdown is set at $2,000, the initial drawdown threshold will be $48,000. Over time, if the account balance grows—for instance, to $56,000 after one month—the maximum drawdown limit will still cap at $50,000. It will not rise above the original starting balance, ensuring a fixed upper limit on the drawdown threshold.

Practical Example: EOD Trailing Drawdown

Consider an account starting with a balance of $50,000 and an EOD drawdown limit of $2,500:

- Trade 1:

- Profit: $1,200

- New Balance: $51,200

- EOD Drawdown Threshold: Adjusted to $48,700

- Trade 2:

- Loss: $800

- New Balance: $50,400

- EOD Drawdown Threshold: Remains at $48,700

- Trade 3:

- Profit: $1,700

- New Balance: $52,100

- EOD Drawdown Threshold: Adjusted to $49,600

- Trade 4:

- Loss: $1,000

- New Balance: $51,100

- EOD Drawdown Threshold: Remains at $49,600

- Trade 5:

- Profit: $2,000

- New Balance: $53,100

- EOD Drawdown Threshold: Stops adjusting and remains fixed at $50,000, as the net profit exceeds the $2,500 drawdown limit.

The EOD trailing drawdown aligns with the closing balance each day until the trader’s cumulative profits surpass the drawdown limit. At that point, the drawdown threshold ceases to trail and becomes fixed at the account’s starting balance.

Practical Example: Unrealized Trailing Drawdown

Practical Example: Unrealized Trailing Drawdown

For an account starting with $50,000 and a $2,500 unrealized trailing drawdown:

- Trade 1:

- Unrealized Gain: $1,200

- Peak Balance: $51,200

- Drawdown Threshold: Adjusted to $48,700

- Trade 2:

- Realized Loss: $800

- New Balance: $50,400

- Drawdown Threshold: Remains at $48,700

- Trade 3:

- Unrealized Gain: $1,700

- Peak Balance: $52,100

- Drawdown Threshold: Adjusted to $49,600

- Trade 4:

- Realized Loss: $1,000

- New Balance: $51,100

- Drawdown Threshold: Remains at $49,600

- Trade 5:

- Unrealized Gain: $2,000

- Peak Balance: $53,100

- Drawdown Threshold: Stops adjusting and remains fixed at $50,000, as the net profit surpasses the $2,500 drawdown limit.

Understanding the Unrealized Trailing Drawdown

An unrealized trailing drawdown is calculated based on the highest peak value of the account balance, regardless of whether the trade closes profitably. For example, if a trade temporarily reaches an unrealized profit of $2,000, pushing the account balance to $52,000, the drawdown threshold will adjust to $49,500. Even if the trade ultimately closes at break-even, the $52,000 peak remains the reference point, leaving only $500 of drawdown cushion.

This highlights the importance of strategic risk management, as the drawdown limit under this system is sensitive to temporary peaks, adding additional constraints to trading decisions.

In simple terms:

- End-of-Day (EOD) Drawdown: Favors traders.

- Intraday Trailing Drawdown: Favors the proprietary firm.

Traders generally prefer the EOD drawdown. So, why is it considered acceptable to work with a proprietary firm that uses an intraday trailing drawdown? It’s because the other benefits offered by the firm often outweigh the drawbacks of this type of drawdown. Also the trailing drawdown is not as signifcant for PATS traders focusing mainly on small to medium scalps.